PURPOSE

Moving averages tend to catch the trend, with some delay. This delay is a lag – average line ‘lags’ the price movement. New, zero lag averages try to minimize this lag.

We have use these New Generation Moving Average and made few setups which ar very helpful in your trading. Following are the list of set ups available in our charting software which uses these MA’s:

- #!S2-JMA

- #Dickson-MA

- #!S2-JMA-2MA

- #!S2-MultiJMA-IND

- #Dickson-Jurik

Now we will discuss what these setups are and how can we get benefit by using these?

1. S2 JMA

INPUTS

We have 4 inputs for this indicator.

- FAST refers to the MA period.

- POW is used to regulate the MA Line. You can choose any one from 1, 2, 3 or 4. Input 1 means the MA line will turn slower while input 4 mean MA line will turn faster.

- COLOR OF JMA is used for the MA Line color.

- LINE THICKNESS is used for the size of MA Line.

We often use Moving Averages to know about the trend. So by nature, MA Lines should be used for the purpose of duration of an existing trend.

So if you are a Short Term Traders (Holding Period 1 Day to 5 Day) then use should chose Higher POW (3 or 4) and Higher MA Value (34 or 55) and if you are a Long Term Trader (Holding Period 1 week to few Month) then you should chose lower POW (1 or 2) and Moderate MA value (21, 34 or 55). For the purpose of investments you should chose Moderate POW (2 or 3) with Higher MA Value (55, 89 or 144).

HOW TO INTERPRET

These MA are Smart with low lag. They create less noise while giving better timing for trend reversal.

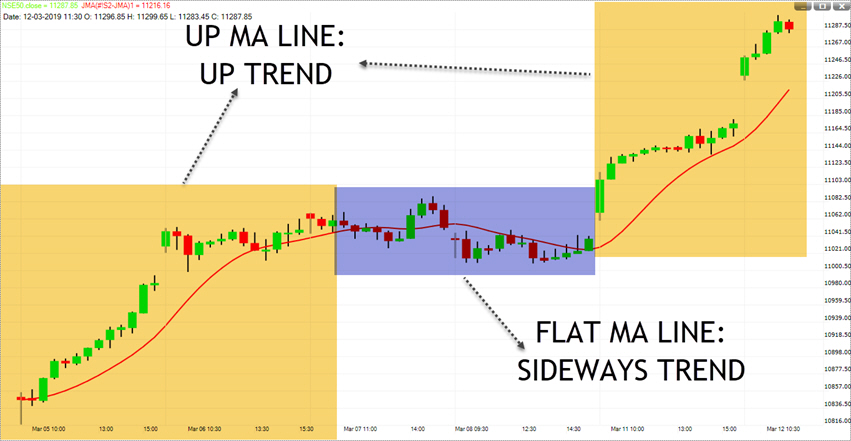

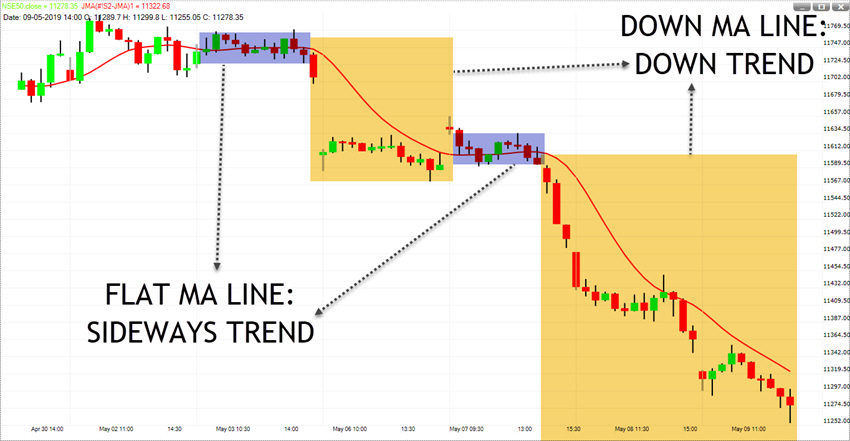

It is an easy tool to identify a trend. Uptrend when MA Line is moving up, downtrend when MA Line is moving down. Sometimes MA Line becomes flat which means sideways trend.

2. DICKSON-MA

INPUTS

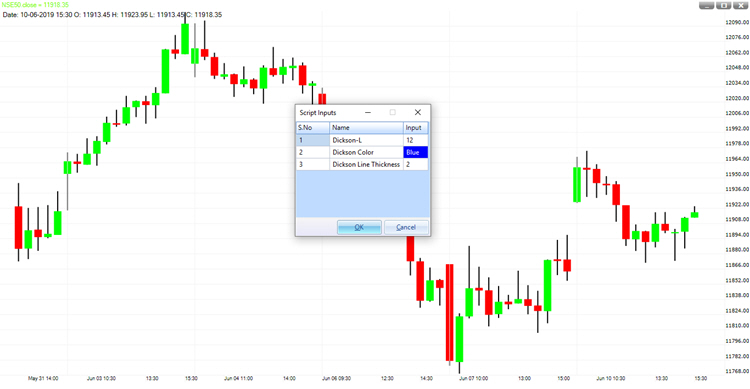

We have 3 inputs for this indicator.

- DICKSON-L refers to the MA period.

- DICKSON COLOR is used for the MA Line color.

- DICKSON LINE THICKNESS is used for the size of MA Line.

As we have discussed above, we often use Moving Averages to know about the trend.

So if you are a Short Term Traders (Holding Period 1 Day to 5 Day) then use should chose Moderate MA Value (13 or 21) and if you are a Long Term Trader (Holding Period 1 week to few Month) then you should chose Moderate MA value (34 or 55).

This indicator is not suitable for the purpose of investments. However it is very useful for intraday trading.

HOW TO INTERPRET

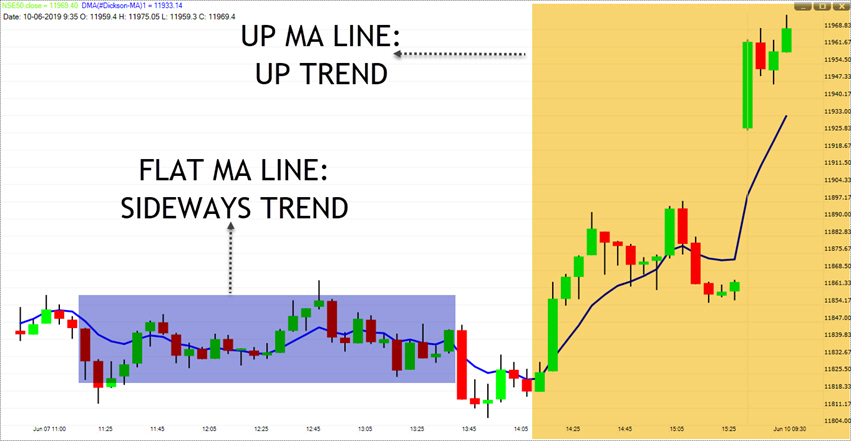

The rules are same as S2-JMA. Uptrend when MA Line is moving up, downtrend when MA Line is moving down. Sometimes MA Line becomes flat which means sideways trend.

However this MA moves almost with the prices. So we may see a lot of whipsaws if we are using it. So it is wise to use it with SA-JMA. We will discuss the rules later in this write-up.

3. S2 JMA 2MA

INPUTS

We have seven inputs for this indicator.

FAST-1 refers to the MA period. Use a lower value to make it a short term moving average.

POW-1 is used to regulate the MA Line. You can choose any one from 1, 2, 3 or 4. Input 1 means the MA line will turn slower while input 4 mean MA line will turn faster.

COLOR OF S2-JMA-1 is used for the MA Line color.

FAST-2 refers to the MA period. Use a higher value to make it a long term moving average.

POW-2 is used to regulate the MA Line. You can choose any one from 1, 2, 3 or 4. Input 1 means the MA line will turn slower while input 4 mean MA line will turn faster.

COLOR OF S2-JMA-2 is used for the MA Line color.

LINE THICKNESS is used for the size of MA Line.

We recommend using the default inputs. However you can edit as per your requirements.

HOW TO INTERPRET

Moving average crossovers are a common trading system which most trader use.

A bullish crossover occurs when the shorter moving average crosses above the longer moving average. This is also known as a golden cross.

A bearish crossover occurs when the shorter moving average crosses below the longer moving average. This is known as a dead cross.

These signals work great when a good trend takes hold. However, a moving average crossover system will produce lots of whipsaws in the absence of a strong trend.

Blue Line is the faster Moving Average (i.e. a shorter period Moving Average) while Black Line is the slower Moving Average (i.e. a longer period Moving Average).

When Blue Line crosses above the Black Line, a long position is taken here.

When Blue Line crosses below the Black Line, a short position is taken here.

When Blue Line is above Black line, then turn down, find support at black line and again turn up, a long position can be taken as a buy at support.

When Blue Line is below Black line, then turn up, find resistance at black line and again turn down, a short position can be taken as a sell at resistance.

4. S2 MULTI JMA

INPUTS

We have seven inputs for this indicator.

- POW is used to regulate the MA Line. You can choose any one from 1, 2, 3 or 4. Input 1 means the MA line will turn slower while input 4 mean MA line will turn faster.

- JURIK-L1, JURIK-L2, JURIK-L3, JURIK-L4, JURIK-L5 refers to the MA period. Use from a set of lower value to higher value. For example: 11, 21, 31, 41, 51 or 8, 12, 16, 20, 24 etc.

- JURIK COLOR is used for the MA Line color.

HOW TO INTERPRET

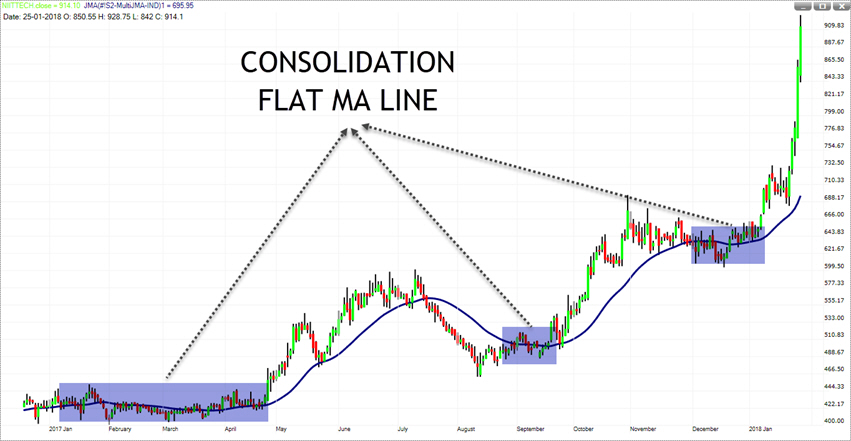

We have already discussed S2 JMA in this blog. S2-MULTI JMA uses multiple S2 JMA and the shows them in a single line.

This indicator is very helpful for managing position for Positional and Investor.

As the indicator uses a variety of MA values, so it shows how strong a trend is.

In a strong trending market, indicator keeps moving in a single direction. Minor dips do not result as a whipsaw. However those dips can be an ideal opportunity to add position.

When markets are in a phase of consolidation, the indicator become flat and turns up when prices came out from that consolidation.

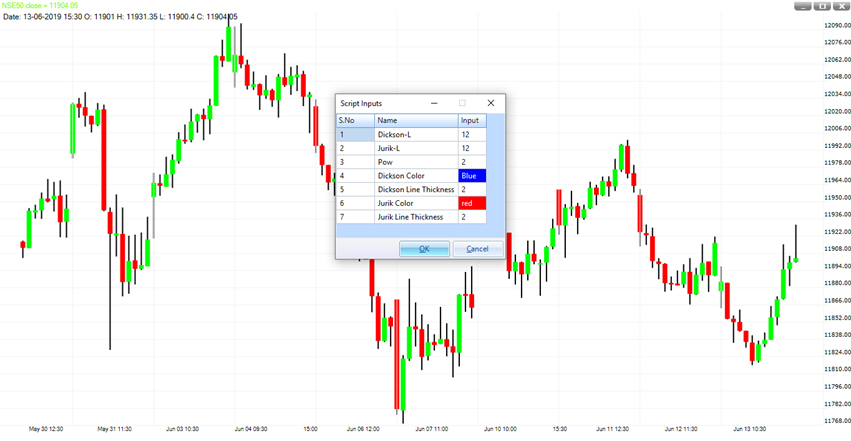

5. DICKSON-JURIK

INPUTS

We have seven inputs for this indicator.

- DICKSON-L refers to the MA period of DICKSON Moving Average.

- JURIK-L refers to the MA period of S2 JMA.

- POW is used to regulate the MA Line. You can choose any one from 1, 2, 3 or 4. Input 1 means the MA line will turn slower while input 4 mean MA line will turn faster.

- DICKSON COLOR is used for the DICSON MA Line color.

- DICKSON LINE THICKNESS is used for the size of DICKSON MA Line.

- JURIK COLOR is used for the S2 JMA Line color.

- JURIK LINE THICKNESS is used for the size of S2 JMA Line.

We recommend using the default inputs. However you can edit it as per your requirements.

HOW TO INTERPRET

Moving average crossovers are a common trading system which most trader use.

A bullish crossover occurs when the shorter moving average crosses above the longer moving average. This is also known as a golden cross.

A bearish crossover occurs when the shorter moving average crosses below the longer moving average. This is known as a dead cross.

We have already discussed this concept above in S2 JMA 2 MA Indicator.

As discussed these signals work great when a good trend takes hold. However, a moving average crossover system will produce lots of whipsaws in the absence of a strong trend.

That disadvantage is less when you use this indicator. With default values, both lines move almost same as prices.

In the below chart, see how prices are trading volatile and non-directional. In such environment, most of the crossover system will leave with lots of losses but this indicator not.

As displays in the chart, for the long trade out of 4 trades, 2 trades have given us big profit while other 2 ended with small losses.

For the short trade out of 5 trades, 1 trade has given us big profit, 1 trade has given us average profit, 1 trade ended at breakeven and rest 2 trades ended with small losses.

Blue Line is the DICKSON LINE while Red Line is the S2 JMA LINE.

When Blue Line crosses above the Red Line, a long position is taken here.

When Blue Line crosses below the Red Line, a short position is taken here.

1 thought on “New Generation Moving Averages”