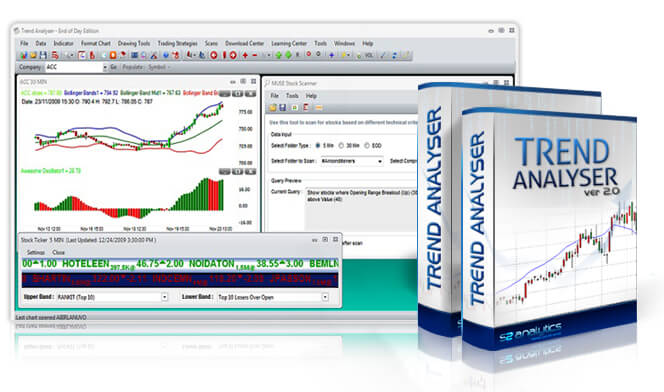

Trend Analyser

Trend Analyser is a professional charting and analysis software that comes with state-of-the-art tools to determine trend, momentum, buy and sell points for stocks.

|

Preferred Time: 15 Minutes, 30 Minutes, 60 Minutes. Strategy Type : Carry Forward. Description: Adaptive in nature. Buying on dips and selling on rallies. |

Details: As the markets are changing so it is wise to use that indicator which adapts quickly the market behaviour as then change. Stratgey ues advance oscillator with an adaptive level of overbought and oversold zone. |

|

Preferred Time: 15 Minutes, 30 Minutes Strategy Type : Carry Forward. Description: Trend following strategy. Buy when fast SMA crosses above slow SMA and sell when fast SMA crosses below slow SMA. |

Details: Moving average crossovers are a common way traders can use Moving Averages. A bearish crossover occurs when the shorter moving average crosses below the longer moving average. This is known as a dead cross. These signals work great when a good trend takes hold. However, a moving average crossover system will produce lots of whipsaws in the absence of a strong trend. |

|

|

|

|

|

|

|

|

|

Preferred Time: 5 Minutes, 15Minutes Strategy Type : Intraday Description: Buy when prices crosses above first 'n' bar high. Sell when prices crosses below first 'n' bar low. |

Details: Any stock creates a range (high to low) in the first 'n' minutes of trading in a day. We call it Opening Range. The highs and lows of this time duration are taken as support and resistance. Buy when the stock moves above the Opening Range High. Stop should be placed at Opening Range Low. |

|

Preferred Time: 15 Minutes, 30 Minutes Strategy Type : Carry Forward. Description: Buying on a dip if prices are in uptrend. Sell on rallies if prices are in a downtrend. ATR based stop & target. |

Details: The strategy is based on two moving averages. First we establish a trend up or down. In an uptrend, the strategy tries to identify a support on dip to take a long trade while in a downtrend, the strategy tries to identify a resistance on rally to take a short trade. The strategy also has ATR based stop & target which assess the current momentum and then suggests us an appropriate level to take profits or losses. |

|

|

|

|

|

|

|

|

|

Preferred Time: 15 Minutes, 30 Minutes Strategy Type : Carry Forward. Description: Short only trend following system. |

Details: Try to capture a down trend and then ride that trend until a reversal. |

|

Preferred Time: 15 Minutes, 30 Minutes Strategy Type : Carry Forward. Description: Long only trend following system. |

Details: Try to capture an uptrend trend and then ride that trend until a reversal. |

|

Preferred Time: 15 Minutes, 30 Minutes Strategy Type : Carry Forward. Description: Once a range develops, prices tend to trade inside the boundaries. A move beyond these boundaries may give us a trending move. We have developed this strategy to catch those moves. |

Details: Channels are lines set above and below the price of a security. The upper channel is set at the x-period high and the lower channel is set at the x-period low. Channels can be used to identify upward thrusts that signal the start of an uptrend or downward plunges that signal the start of a downtrend. Price Channels can be used to identify strong moves that may result in lasting trend reversals. Securities that continuously exceed the upper channel line show strength. Conversely, securities that continuously break the lower channel line show weakness. We have an inbuilt trailing stop and target in this strategy which helps us to manage the risk.. |

|

Preferred Time: 15 Minutes, 30 Minutes, 60 Minutes, 90 Minutes Strategy Type : Carry Forward. Description: A breakout trading system tries to ride the new trend as long as it last. |

Details: The strategy tries to identify a period of accumulation and then identify a likely resistance or support levels. Trades come when either of these levels get penetrated. Then the strategy ride the trend as long as it last. |

|

|

|

|

|

|

|

|

|

Preferred Time: 15 Minutes, 30 Minutes Strategy Type : Carry Forward. Description: A mixture of Momentum and Volatility based trend following strategy. |

Details: The strategy considered the current volatility and momentum and then compare it with price trend. If stratgey concludes an uptrend then it gives a long trade and if stratgey concludes a downtrend then it gives a short trade. This is a continuous trading system which tries to ride the trend as long as it last. |

|

Preferred Time: 15 Minutes, 30 Minutes Strategy Type : Carry Forward. Description: Range Breakout system with proper stop & target. |

Details: Markets go through the cycle of Contraction and Expansion. This strategy helps you to catch the expansion. For identifying a contraction we have used a tool which helps us to identify a trading range. Very often the expansion comes in the direction of main trend. For this purpose we have given a filter of trend as a Zero Lag Moving Average (ZMA). This strategy allows you to take the trade in the direction of ZMA. Now we don’t know when this expansion will end and also when it is going to fail. For this purpose we have used ATR based Stop and Target. We are maintaining a ratio of 1:2 for stop and target.. |

|

|

|

|

|

|

|

|

|

Preferred Time: 15 Minutes, 30 Minutes Strategy Type : Carry Forward. Description: Trend following strategy. |

Details: The stratgey tries to capture the high and lows of a swing. When the strategy identified a high it will give you a short trade and when the strategy identified a low it will give you a long trade. This strategy is very fast and trailing in nature. |

|

|

|

Preferred Time: 15 Minutes, 30 Minutes Strategy Type : Carry Forward. Description: Trend following strategy. Compare the relation between price and moving average. |

Details: Crossovers are one of the main moving average strategies. The crossover, which is when the price crosses above or below a moving average to signal a potential change in trend. |

|

Preferred Time: 15 Minutes, 30 Minutes Strategy Type : Carry Forward. Description: Trend following strategy. Buy when fast SMA crosses above slow SMA and sell when fast SMA crosses below slow SMA. |

Details: Moving average crossovers are a common way traders can use Moving Averages. A bearish crossover occurs when the shorter moving average crosses below the longer moving average. This is known as a dead cross. These signals work great when a good trend takes hold. However, a moving average crossover system will produce lots of whipsaws in the absence of a strong trend.. |

|

|

|

|

|

|

|

|