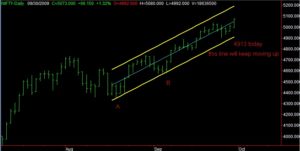

The recent up move for the Nifty fits a trend channel well. The Nifty chart below shows the channel as well as the A & B points from which the lower trendline has been made.

A move below the lower trend line will be a signal tht the current up move is facing a correction or whatever. This is simple technical analysis, but effective.

If we follow this method, then we are unlikely to sell at the very top. Prices will have to come down about 150 points before a down move is signaled. Now, think about this: is this so terrible? In an uptrend, do you really want to go-short every time the Nifty moves down just a little bit?

As I write, U.S. markets are down. It is possible that this weakness can continue till the close, and, may then affect the Indian markets tomorrow. If you are a day / swing trader, you may like to use the 15 minute rule to go short in the Nifty. You should also keep some rules with you on the short term trend. What will signal a change in the trend from up to down? I have given one rule here – the channel. You must have some method of your own. So far the short term trend is up, short positions carry high risk, so keep volumes down, and follow your stops.

Inside a trading range

The Nifty has this tendency to go through a big move (range expansion) and then huddle inside a range for many days. This is the cycle of expansion and contraction. The trading range represents contraction.

Currently, we are inside a trading range after the up move from 4800 to 5000. Now, the trend is up. Then, the trader assumes that the move out of this range will be on the upside. Remember this is a probability since prices should continue with the trend after a consolidation. For this reason, I do not suggest going short while we remain inside a range, not in my letter to clients, and, not on TV.

What is the next step for the Nifty?

The range is pretty narrow, 4950 – 5020 approx.

(1) The Nifty closes above 5020, and continues its up thrust. Fine.

(2) The Nifty decides to go fo a correction, closes below 4950. Most traders should simply close long positions and wait it out. Professional traders can try to catch the downside, understanding that this is a correction. But then, you never know!

(3) The problem comes on a fakeout. If the Nifty close above 5020, then declines to finally move down, the trader is left holding a loss. Pity, but that’s the way it is.

Technical and Fundamentals:

Shazia asks if we should ignore fundamentals altogether. My answer would be: yes. For trading, do not even think about what the fundamental news flow is saying. But, I use the fundamentals to filter a list of stocks to invest or trade. When we make a list of stocks for position trading, we check their earnings. If the company has not earned during the latest quarter, we discard it. Our position trades last for a couple of weeks, yet, I do require that we start with essentially profitable companies. The information is available at the NSE and BSE web sites – that is enough.