Type of Day’s movements: Markets are uncertain. They don’t have any structure. So we should be always ready to face any type of movements.

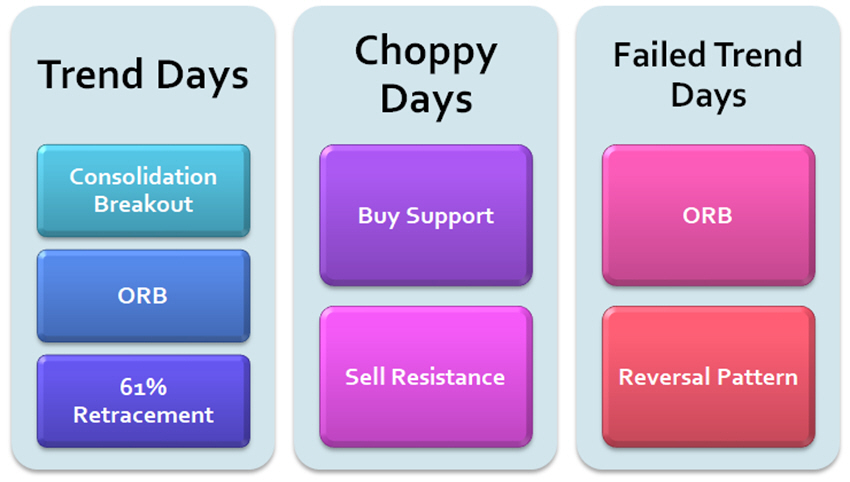

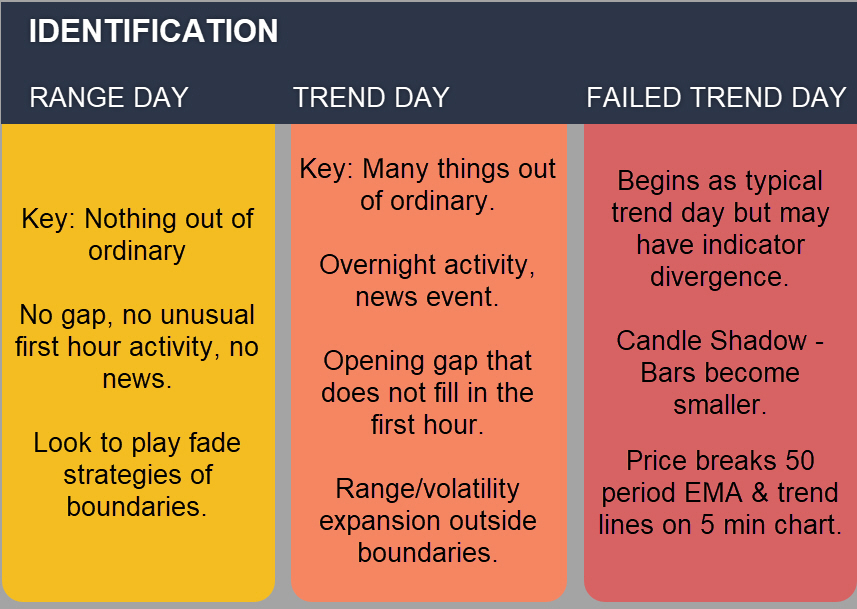

Type of Days: We can classify Intraday movements in 3 types:

Trend Days: Our Definition of Trend Day is, “Price breaks above or below the First 15 min High or Low. If breakout happens on upside then it should not break below the First 15 min low and vice-versa.”

Failed Trend Days: Price breaks above or below the First 15 min High or Low. After the breakout prices should break on the opposite side only once.

Range Days: Prices breaks above or below the First 15 min High or Low. After the breakout prices should break on the opposite side and then again price breaks the opposite side and continues.

Trade Plan

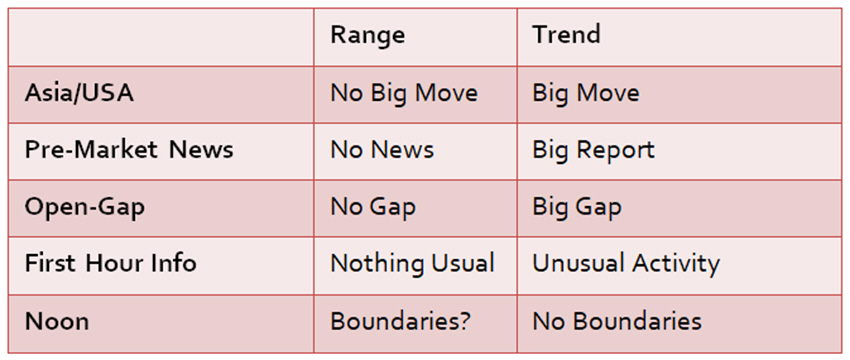

Determine type of day structure: Doing so helps determine what trades to take.

Time Sequence Checklist:

Unusual Activity Includes:

- High Relative Volume (above average of last 10 days)

- High Volatility/Clear Range Expansion/Breakout

Rule of Detection: Start with assumption it will be a Range Day. Market must prove it has broken into trend. Make note of unusual activity at time markers. Even if market shows trend day behavior early, monitor objectively throughout the day.

Excellent!!!! couldn’t be explained in easier way then this…..