Forming a plan for market movements

Markets do not have an organized structure. In the absence of a formal structure, traders should develop some kind of a structure to track market movements. This structure should be valid on all time frames – long term, short term….

Our Model for Trading in the Markets

Market cycles work on Wyckoff’s movements. Accumulation and Distribution stages contain classical chart reversal patterns – Double bottom/Top, head and shoulders. Markup and Markdown phases follow Dow Theory concepts of higher/lower – highs / Lows.

Most of Time Markets are Efficient

We make the mistake of believing that the profits have come because of some exceptional skill that we possess. ‘Mostly efficient’ means price movements are mostly random. Many of our profits come due to ‘Luck’.

It’s not easy to predict the market. A trader can overcome the randomness of the market through a “TRADING EDGE.” Non Random periods (“Trading Edge”) are different for each trader.

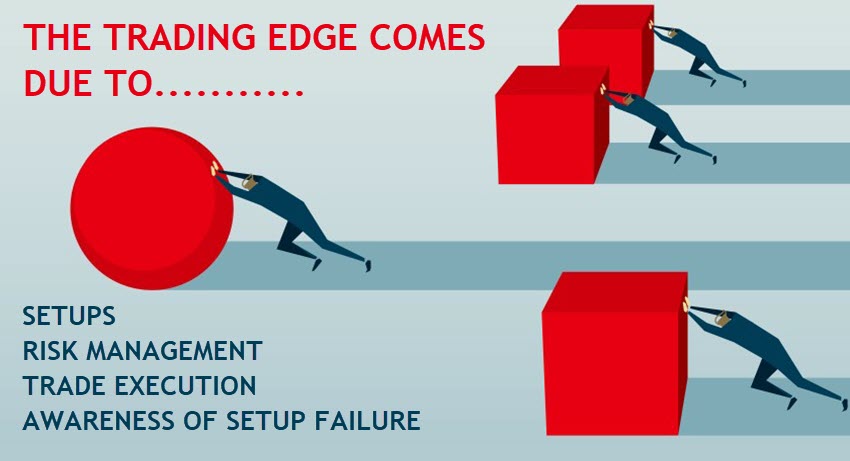

The Trading Edge

The Trading Edge is the positive expectancy of the trades. The trader is the trading edge.

The Trading Edge – Who is in Control?

Buying and Selling Pressure moves prices.

More buying pressure = higher prices

Urgency to sell = lower prices

Our Edge comes from imbalance…

Every edge we have as traders comes from an imbalance of buying and selling pressure. When both sides are evenly matched, prices are random; trading becomes a loss making idea. We must limit our involvement to those points where there is an actual imbalance between buyers and sellers.

We analyze patterns since they often identify areas of imbalance between buyers and sellers. UNDERSTAND …. We do not trade patterns. We trade those imbalances that create those patterns.

Who is in control?

We must ask this question: Who is in Control?

The Answer is:

- Buyers

- Sellers

- Equally balanced