Often, on Business TV, anchors will discuss the out-performance and under-performance of mid caps relative to large caps.

When mid caps are doing better, sometimes the suggestion is that the out performance suggests that the bull market is intact because there is much broader participation in the rally – because the mid caps are joining the party.

Sometimes, the mid caps are outperforming, then the anchors get worried that the bull market may be coming to an end since the mid caps are leading the way which usually happens in he fag end of a bull move.

It is easy to analyze and provide commentary suitable to the time and environment. Luckily, Such analysis does not have to be supported by any research.

But traders are not analysts. They trade with real money, therefore, any view that they develop MUST be supported by adequate knowledge.

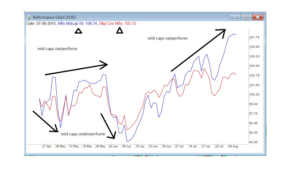

I am giving below a chart of the Nifty and the NSE50 mid cap Index. The Blue line is the midcap and the Red line is the Nifty. Note how the Nifty outperforms sometimes, while the mid cap moves ahead at some other times.

This is normal. Often, there is sector rotation so a sector starts moving which may consist mainly of mid cap stocks. Mid cap stocks by themselves cannot predict the continuation or end of a bull market.

For traders, the above chart is providing trading setups. When the Midcap50 starts outperforming the Nifty, it may be worthwhile to focus on mid caps.