The head and shoulders pattern is generally considered as a reversal pattern. The pattern signals both upside and downside reversal. The concept behind this pattern is:

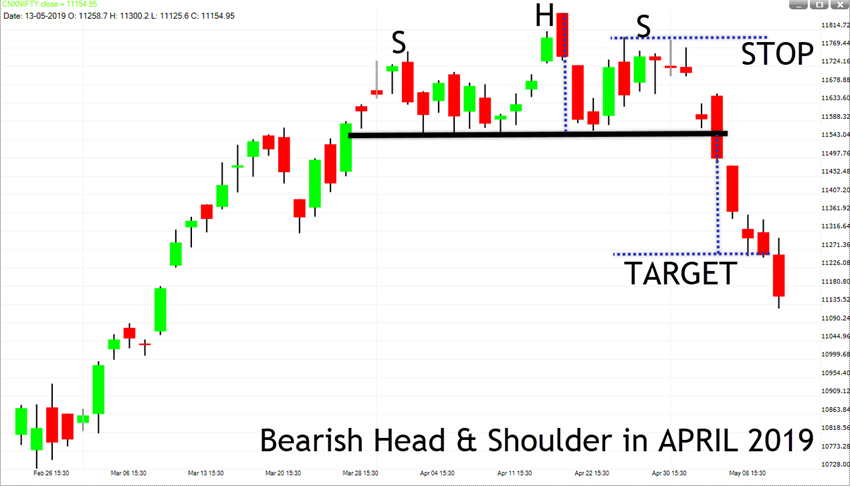

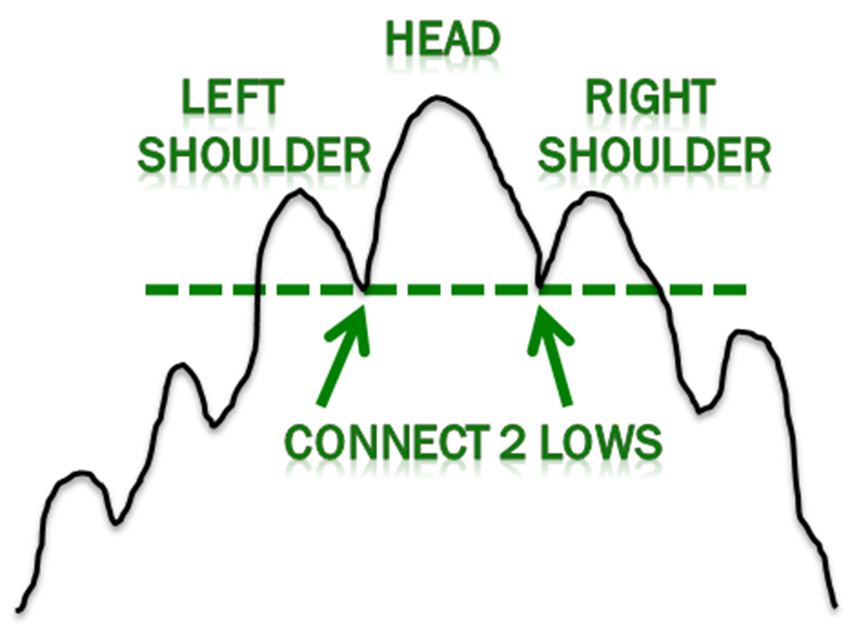

Bearish Head & Shoulder (found at the top of a rally):

The market begins to slow down. Supply and demand are in equilibrium. Prices made a pivot high there and then sellers come in at the highs. This creates the LEFT SHOULDER.

Sooner the downside is probed and buyers soon return to the market and ultimately push through to new highs. This creates the HEAD.

However, the new highs are quickly turned back and the downside is tested again. Tentative buying re-emerges and the market rallies once more, but fails to take out the previous high. This creates the RIGHT SHOULDER.

Sellers come again at this top of the RIGHT SHOULDER and push the prices on downside.

A trend line from the beginning of this pattern – low made after the left shoulder and then again low made after the head is called the NECKLINE for this pattern.

A breakdown from this neckline completes and confirms the pattern.

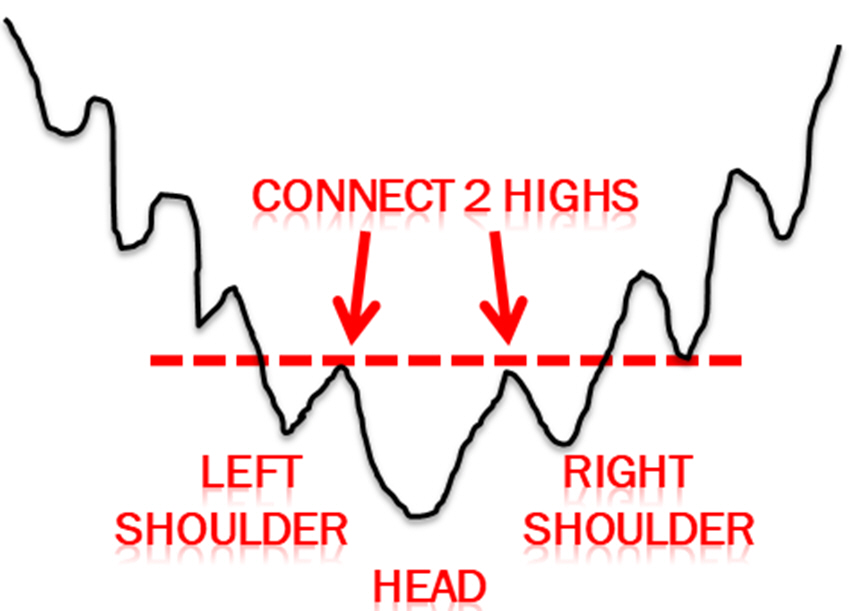

Bullish Head & Shoulder (found at the bottom of a decline):

The decline begins to slow down. Supply and demand are in equilibrium. Prices made a pivot low there and then buyers come in at the lows. This creates the LEFT SHOULDER.

Sooner the upside is probed and sellers soon return to the market and ultimately push through to new lows. This creates the HEAD.

However, the new lows are quickly turned back and the upside is tested again. Tentative selling re-emerges and the market declines once more, but fails to take out the previous low. This creates the RIGHT SHOULDER.

Buyers come again at this low of the RIGHT SHOULDER and push the prices on upside.

A trend line from the beginning of this pattern – high made after the left shoulder and then again high made after the head is called the NECKLINE for this pattern. A breakout from this neckline completes and confirms the pattern.

Few characteristics:

- The pattern must form after an extended move.

- The neckline should be horizontal.

- The shoulders should be on the same horizontal plan.

- Volume should increase on the breakout.

Please Remember:

- Patience to wait for the best formation

- Knowing the essence of the formation

- Time element

- Technical Analysis is not 100%!

Example: Recent Head & Shoulder in NIFTY daily Chart