The government on Monday, June 24th, announced several measures to bail out the ailing sugar industry: While the rate of import duty was more than doubled from 15 per cent to 40 per cent, the mandatory ethanol-blending cap was increased from five per cent to 10 per cent. The notifications in this regard will be issued shortly after the industry assures of clearing farmers’ Rs 11,000-crore dues at the earliest. (Source: Business Standard)

While such measures could act as sweeteners for Sugar companies, it is also known that sectors like sugar undergo cycles of high and low performance. I feel it is time to review one of the seemingly promising stocks from the Sugar Sector right now, Bajaj Hindustan here:

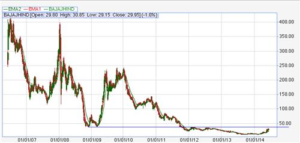

If we look at its last 3 years chart, it is just shows the pain is has been undergoing, from Rs. 80 to around 10. But since last 6 months, that trend seems to be somewhat changing. Looking at its long term chart of 8 long years starting 2007, it shows the volatility it saw:

But to me, the most eye catching part is the base that the stock has been forming. Around Jan 2009, BajajHind took support at the price of around 37-38 twice and from it again reversed its trend then to touch around 250 levels. From there, it saw a one way down trend to around the price of 10, 37-38 now acting as a resistance. Also, it shows that BajajHind is seemingly forming a rounding bottom, and if it breaks above its long term resistance price of around 37-40, it may well imply breaking out of the rounding base, and also change in its trend. As Sudarshan Sir keeps telling us, no stock can change its longterm trend overnight. It first needs to form a base. That is exactly what this stock seems to be doing. May be too early to say, may be not! Time will tell..

In any case, isn’t it worth keeping a watch on?

Great Bear Of Wall Street

Jesse Lauriston Livermore (July 26, 1877 – November 28, 1940), also known as the Boy Plunger and the Great Bear of Wall Street, was an American stock trader. Born in Shrewsbury, Massachusetts, Jesse Livermore started his trading career at the age of fourteen. He ran away from home with his mother’s blessing to escape a life of farming his father intended for him.

While working at Paine Webber brokerage in Boston, a friend convinced him to put his first actual money on the market by making a bet at a bucket shop. By the age of fifteen, he had earned profits of over $1,000 (which equates to about $23,000 today). In the next several years, he continued betting at the bucket shops. He was eventually banned from most bucket shops for winning too much money from them.

During his lifetime, Livermore gained and lost several multi-million dollar fortunes. Most notably, he was worth $3 million and $100 million after the 1907 and 1929 market crashes, respectively. $100 million in 1929 would be over $125 billion today. Livermore first became famous after the Panic of 1907 when he sold the market short as it crashed.

He continued to make money in the bull markets of the 1920s. In 1929, he noticed market conditions similar to that of the 1907 market. He began shorting various stocks and adding to his positions, and they kept declining in price. When just about everyone in the markets lost money in the Wall Street crash of 1929, Livermore was worth $100 million after his short-selling profits.

Livermore was declared bankrupt in 1912 because of adding on to his losing positions and lost all of his money which he earned in 1907 crash. Through unknown mechanisms, he yet again lost much of his trading capital, accumulated through 1929 and went bankrupt again in 1934.

QUOTES:-

(1) All through time, people have basically acted and reacted the same way in the market as a result of: greed, fear, ignorance, and hope. That is why the numerical formations and patterns recur on a constant basis.

(2) The game of speculation is the most uniformly fascinating game in the world. But it is not a game for the stupid, the mentally lazy, the person of inferior emotional balance, or the get-rich-quick adventurer. They will die poor.