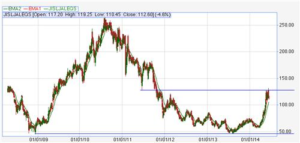

Jain Irrigation exists in a sector that has great future prospects, the sector of micro irrigation & sprinkler irrigation systems along with its ancillaries. From its price of over 250 in 2010, it hit its bottom of around 50 in Aug’13, the same support it respected in Jan’09. From there, it has been trying to recover and right now it standing at its resistance of 125-128, as can be seen here:

Broadly, markets are in a bull market right now. In such a scenario, stocks such as Jain Irrigation may be kept in sight well before they start their independent bull run, which may be with a speed more than the broader markets. Breaking out of this resistance would mean something similar to breaking out of its rounding bottom, which may mean reversal of its trend! I guess then we can be optimistic, even as a conservative trader!

Do not mistake this as our attempt to predict the tomorrow. Can we? Should we? The concluding statement answers these questions, and i love it:

“Those who have knowledge don’t predict. Those who predict don’t have knowledge”

-Lao Tzu. Sixth century BC.

Tighten Your Stops

Often, this term is used to advise traders: The markets are volatile OR The market may reverse OR The market is looking overbought, So, ‘Tighten Your Stop’.

How should the trader implement this advice to ‘Tighten the stop’ ?

The objective of ‘Tighten your Stop’ is to reduce the risk and/or lock-in profits. As we hold a position over time and the paper profits begin to build, we periodically adjust the Stops to lock a larger percentage of our gains as time passes by. By tightening the Stops, we reduce the risk of incurring losses – reduce the risk of allowing profits to slip away.

Process:

If you have a Buy (long) position, then:

1. Identify the nearest support level. This can be a Pivot Low, or a consolidation. Put your stop just below the support.

2. Calculate the 8 or 13 period moving average. Your stop should be moved just below the average. If you really want to tighten, then use a 5 period average.

3. Locate a Fibonacci retracement of the nearest up swing. Keep a stop at 50% retracement of this up move. If the 50% is far away, then use the 38% retracement, or even 23% if neccessary.

If you have a Sell (short) position, then:

1. Identify the nearest resistance level. This can be a Pivot High, or a consolidation. Put your stop just above the resistance.

2. Calculate the 8 or 13 period moving average. Your stop should be moved just above the average. If you really want to tighten, then use a 5 period average.

3. Locate a Fibonacci retracement of the nearest down swing. Keep a stop at 50% retracement of this down move. If the 50% is far away, then use the 38% retracement, or even 23% if neccessary.

Discipline

Once a stop is installed, it cannot be moved lower for a buy and higher for a sell. Stops for buy positions can only be moved higher, while stops for short positions can only be moved lower.