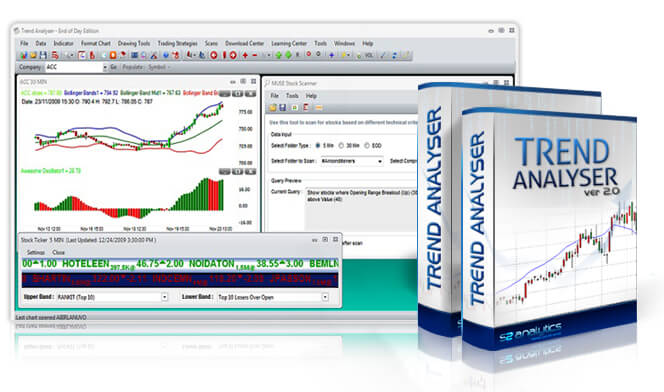

Trend Analyser

Trend Analyser is a professional charting and analysis software that comes with state-of-the-art tools to determine trend, momentum, buy and sell points for stocks.

This page shows in brief some of the top performance achieved by our products. The P/L for futures is for 1 lot.

| Symbol | Profit/Loss | No. of Trades | % Return |

|---|---|---|---|

| IndusInd Bank | Rs 334000 | 91 | 300% |

| Manappuram | Rs 246000 | 46 | 200% |

| Bajaj Finserv | Rs 227000 | 47 | 200% |

To see performance report for stock futures please click here

| Symbol | Profit/Loss | No. of Trades | % Return |

|---|---|---|---|

| Nifty | Rs 125000 | 199 | 100% |

| Bank Nifty | Rs 210000 | 98 | 200% |

To see performance report for index futures please click here

| Symbol | Profit/Loss | No. of Trades | % Return |

|---|---|---|---|

| Lead | Rs 254000 | 93 | - |

| Aluminium | Rs 106500 | 88 | - |

| Gold | Rs 90500 | 113 | - |

To see performance report for metals please click here.

| Symbol | Profit/Loss | No. of Trades | % Return |

|---|---|---|---|

| Siemens | Rs 79000 | 42 | - |

| Raymond | Rs 65000 | 26 | - |

| Star | Rs 60000 | 33 | - |

To see performance report for Day PRO stock futures please click here.

| Closed Trades | Winning Trades | Losing Trades | Success Ratio | Duration |

|---|---|---|---|---|

| 82 | 56 | 26 | 68% | Jan 2017 - Jan 2018 |

Disclaimer:

- All results are based on simulated trading.

- Past performance is no indicator of future performance.

- Derivative trading carries large risk and not suitable for everyone.

Discipline: The key to success is to follow the trading plan. You should be very clear about how to handle your trade.

Planning: One should identify a few stocks and focus on them.

Capital: One should not invest all the capital at once but he should divide his capital in different type of investments.

Volumes: A stock should have enough volumes for it to be tradable.

News Flow: Be cautious when trading on news which is out in the market. It takes a few minutes for a stock price to adjust to any news.

Average Out: When the price of a stock starts falling, people buy more to average out. In trading, it’s a strict ‘No’.