1. PURPOSE

This indicator is designed for better understanding of a trend, trend strength and direction.

2. INPUTS

One of the most important things about using an indicator is the absolute freedom to use whatever values you like.

While this can initially sound positive, the virtually limitless combinations of variables can become quite overwhelming. For example, while using moving averages, a particular stock perform well on a particular value but another stock performs well on another value. We cannot fix the same value for different stocks. Now the question arises, which value should we use?

This indicator is designed in such a manner that there is no need to change the value. This is the reason we have not given any option to change the value of the indicator.

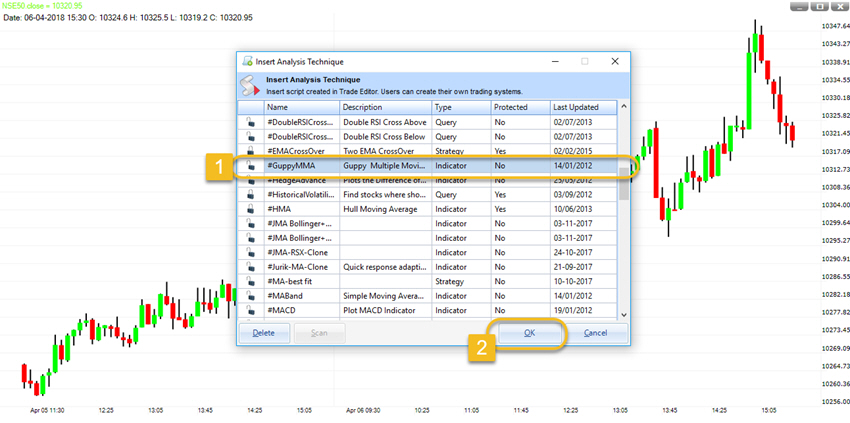

To apply this indicator, first you need to open a chart and then insert #GuppyMMA from the MENU SCRIPT.

At the lower end of SCRIPT List Window you will find a tab named OK. Just click on that.

3. HOW TO INTERPRET

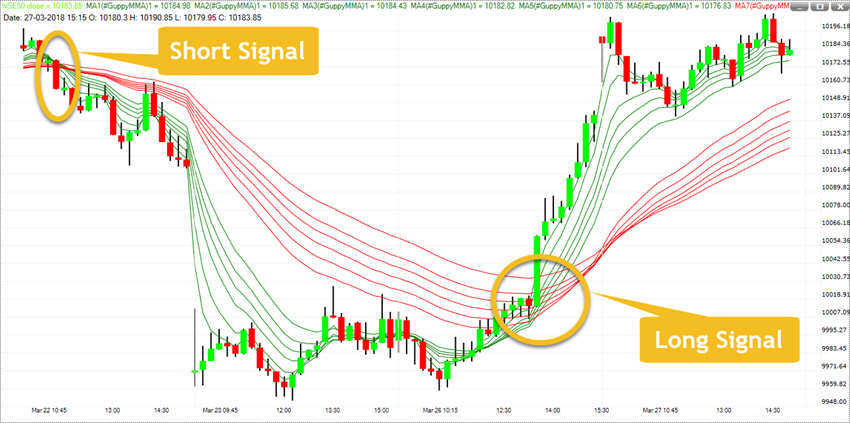

The Guppy Multiple Moving Average (GMMA) Indicator provides an interesting alternative to using any variable you like. The GMMA implements 12 different exponential moving averages (EMAs) in an effort to analyse a market’s behaviour on multiple levels.

Guppy groups the EMAs into two categories. The first six are considered short-term (green color MA) and the other six are considered long-term (red color MA).

The long-term EMAs represent the interests and behaviours of investors that have taken a long-term approach to a given market. The short-term EMAs represent traders, or speculators, who are attempting to capture short-term profits.

Uptrend: When slope of all the lines are upward.

Downtrend: When slope of all the lines are downward.

4. OUTPUT

This indicator can be used by following ways:

- 1. Crossover: The simplest method for using the GMMA indicator is to trade a basic moving average crossover system using all twelve of the GMMAs. This system would buy when all of the short-term GMMAs cross above all of the long-term GMMAs, and sell when the short term GMMAs cross below the long-term GMMAs.

- 2. Trend Direction: Both the long-term and short-term trends are seen as stable when each of their GMMA lines are separated by a uniform distance. In such a case if slope of all the lines are up ward then this is uptrend and if slope of all the lines are downward then this is downtrend.

- 3. Trend Reversal: If the six long-term GMMAs begin to flatten, the long-term trend has become vulnerable. If the short-term GMMA lines begin to separate further and further from each other, the market is likely experiencing a bubble situation and traders should be cautious.

- 4. Sharp Move Identification: When all the twelve lines move very near to each other or conjoining together then there is a strong chance for a sharp move to come.

1 thought on “Guppy MMA”